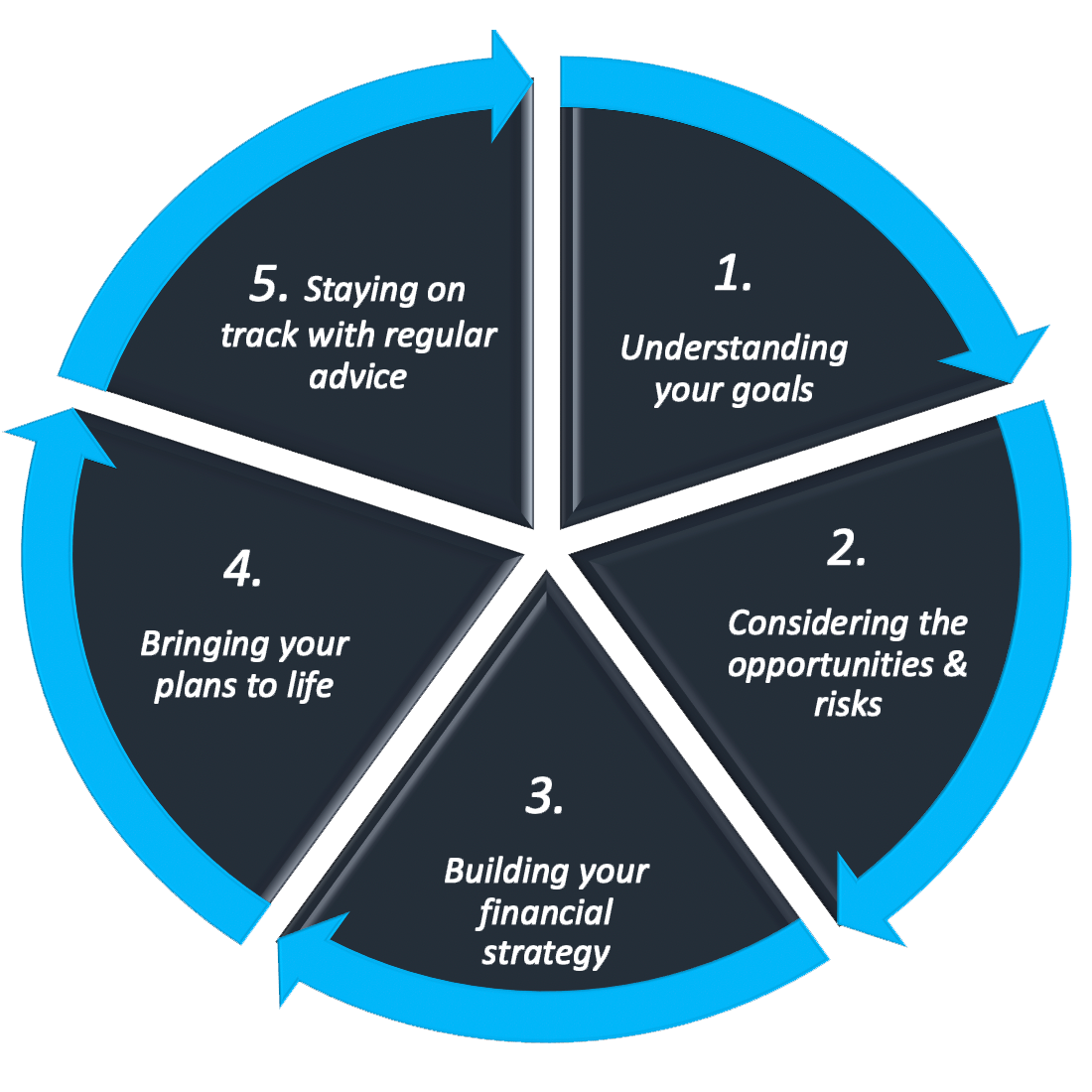

Our Process

Having a plan is the first step of any journey. We look at your holistic financial position, your needs and what you want to achieve in life before helping you plan on how to get there. Ongoing success on your plan requires the ability to monitor change, adapt to shifting circumstances and hold or alter your course accordingly. From our first meeting to helping you stay on track, MPL Wealth Management is here to guide you along the way.

Step 1. Understanding your goals

- Listening carefully and understanding your current situation.

- Work on broad concepts regarding a strategy that would potential work for you. This will incorporate risk tolerance, investments, your tax position, your current cash flow, personal insurance needs, your aspirations for the future etc.

- You provide us with authority to undertake further research into your financial affairs.

Step 2. Considering the opportunities & risks

- Conduct the necessary research from your existing providers allowing us to gain a deeper understanding of your personal and financial situation.

- Analyse the supporting information provided by you and gathered from your existing providers, allowing us to evaluate your overall situation.

- Identify and qualify specific strategies that will benefit you inline with your specific goals and objectives.

- Product and compliance research.

Step 3. Building your financial strategy

- Develop strategies to achieve the desired outcomes as discussed and confirmed in our meeting.

- Ensure multiple strategies work in balance.

- Make written recommendations specifically designed to achieve your objectives.

- Confirm your understanding, and answer any questions you may have about our recommendations.

- Gain authorisation from you to proceed and implement the strategy designed for you.

- Agree to an Ongoing Service Agreement in line with your ongoing needs

Step 4. Bringing your plans to life

- Complete relevant documentation.

- We implement the advice and strategy.

- Track the process and keep your informed of progress made.

- Report to you when the process is completed.

Step 5. Staying on track with regular advice

- Meet annually to review your total financial position, investment portfolio and strategy.

- Revisit your objectives and strategy and talk through any adjustments that may be required to your financial plan.

- We will contact you throughout the year if there are any significant changes that may impact your personal goals and objectives.

- Conversely, you need to make contact with us if there are any significant changes to your personal situation that may impact your personal and financial situation and subsequently your strategy.